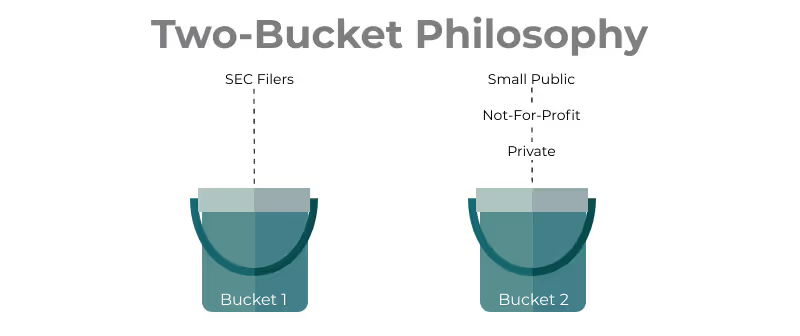

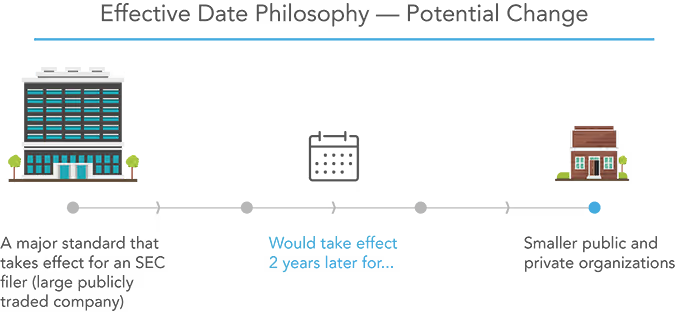

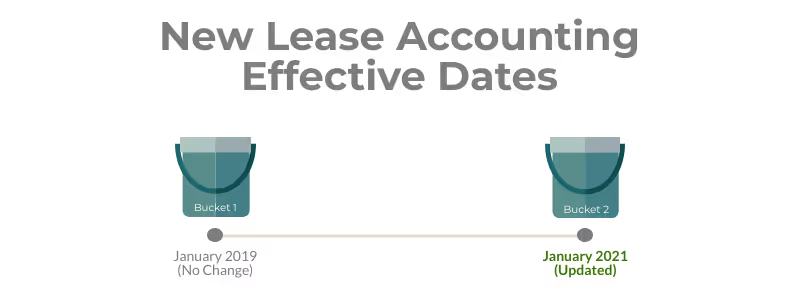

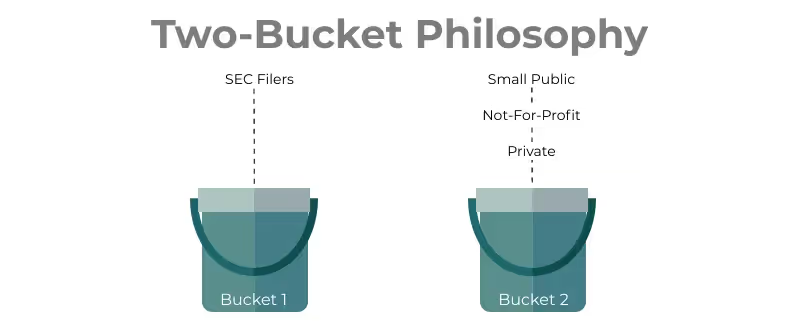

The Financial Accounting Standards Board (FASB) issued an to exposure draft delay the effective date for ASC 842 (Lease Accounting) for certain companies, including private and not-for-profit entities. This was part of a broader standards update where the FASB proposed a two-bucket philosophy for implementation timelines of major updates going forward.

Large public companies that are SEC filers would fall into bucket one, with private, not-for -profit, and select other companies falling into bucket two. For any major Accounting Standards Update (ASU), the FASB proposes that the effective date for bucket two should be staggered two years after the effective date for bucket one.

1. What Does This Mean for Lease Accounting?

Lease accounting was one of the major factors influencing the FASB’s move towards a two-bucket approach. This will give private companies with a previous effective date of January 2020 an extra year to implement the new lease accounting standard. The updated timeline is as follows:

2. Why Would the FASB Delay?

The FASB cited several reasons for the delay including the following:

- availability of resources

- timing and source(s) of education

- knowledge or experience from issues encountered by bucket 1 implementers

- comprehensive transition requirements

- understanding and applying guidance from post-issuance standard-setting activities

Surprisingly, one major driver of this proposed delay was the availability of compliant software solutions. The FASB’s original assessment was that software would not be needed for adopting organizations and that Excel would be sufficient. However, a recent follow-up study by the FASB concluded the contrary, that systems will be required for the majority of adopters. Because of this, “sufficient information technology and expertise in developing new systems or effecting system changes” was also cited as a reason for the delay.

3. Is the Decision to Delay Final?

No, the exposure draft is a proposed Accounting Standards Update published by the FASB. The intent of an exposure draft is to solicit public comment on a new standard in order to minimize any unintended consequences before it is finalized. Moody’s is one of several organizations that is actively opposing the delay, stating that “such delays will hurt reporting transparency affecting a swath of non-financial corporations across different sectors.”

4. What Should Companies Do?

Although there will likely be minor changes to the exposure draft, we expect that the Accounting Standards Update will be finalized sometime during Q4 of 2019, pushing the effective date back for companies in bucket two. Despite the delay, there are several ways companies can prepare for the approaching standard change.

Start Now

Early adoption of ASC 842 is allowed and transitioning onto the standard before the updated deadline is encouraged for many reasons:

- Only an Exposure Draft – Depending on the comments received, it is still possible that the original deadline of January 1, 2020 for most companies remains.

- Comparability – If your business operates in an industry with both public and private companies, early adoption is recommended for comparability.

- Private Equity Backed – Many private equity firms are encouraging early adoption to maintain consistency across both public and private portfolio companies.

- IPO – Non-public businesses that are planning to IPO may be required to accelerate or retroactively apply adoption based on requirements for public business entities.

- IFRS Requirements – If there are any international statutory filing requirements IFRS 16 adoption will be required.

- Practical Expedients – The FASB has offered several practical expedients to make the transition easier, including additional expedients exclusively for private companies. Many of our private customers have taken advantage of these to get up and running faster on the new standard

Select the Right Software

Although there will likely be minor changes to the exposure draft, we expect that the Accounting Standards Update will be finalized sometime during Q4 of 2019, pushing the effective date back for companies in bucket two. Despite the delay, there are several ways companies can prepare for the approaching standard change. For most businesses, a more advanced lease accounting software tool will be required. When selecting the right tool for your business, it’s okay to be skeptical of accounting software. Make sure the tool goes beyond calculating a basic ROU and lease liability (that part is easy). The solution should manage the transition onto the new standard, cover all the required disclosures, handle all types of lease modifications, and be fully transparent and auditable.

Submit Your Comments to the FASB

The FASB is seeking public comment on their exposure draft through September 16, 2019. Companies impacted by the change are asked to provide feedback on the proposed two-bucket approach.

.avif)

.avif)